Paycheck calculator 2021

Ad Learn How To Make Payroll Checks With ADP Payroll. Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary calculators withholding.

New York Paycheck Calculator Adp

To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

. Small Business Low-Priced Payroll Service. Computes federal and state tax withholding for. Get 3 Months Free Payroll.

This number is the gross pay per pay period. We use the most recent and accurate information. 21 hours agoThe income limits are based on your adjusted gross income AGI in either the 2020 or 2021 tax year.

So your big Texas paycheck may take a hit when your property taxes come due. Start free trial with no obligation today. Calculating your Florida state income tax is similar to the steps we listed on our Federal paycheck calculator.

In a few easy steps you can create your own paystubs and have them sent to your email. Fast Easy Affordable Small Business Payroll By ADP. If you want to boost your paycheck rather than find tax.

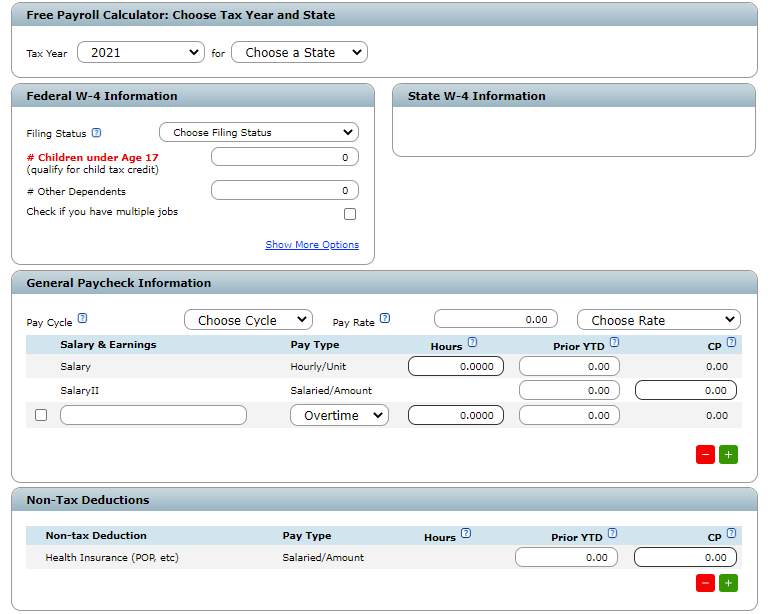

See how your refund take-home pay or tax due are affected by withholding amount. So the tax year 2022 will start from July 01 2021 to June 30 2022. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W-4.

Get 3 Months Free Payroll. Get 3 Months Free Payroll. Ad Calculate tax print check W2 W3 940 941.

Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Ad Create professional looking paystubs. This free easy to use payroll calculator will calculate your take home pay. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Federal Salary Paycheck Calculator. The state tax year is also 12 months but it differs from state to state. All Services Backed by Tax Guarantee.

Find The Best Payroll Software To More Effectively Manage Process Employee Payments. Heres a step-by-step guide to walk you through. It can also be used to help fill steps 3 and 4 of a W-4 form.

2021 2022 Paycheck and W-4 Check Calculator. Estimate your federal income tax withholding. This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees.

People who earned less than 125000 annually or 250000 if filing. Get 3 Months Free Payroll. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Some states follow the federal tax. Supports hourly salary income and multiple pay frequencies. How do I calculate hourly rate.

Free salary hourly and more paycheck calculators. SmartAssets North Carolina paycheck calculator shows your hourly and salary income after federal state and local taxes. Use this tool to.

3 Months Free Trial. Fast Easy Affordable Small Business Payroll By ADP. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier. Oregon Paycheck Calculator 2021 will sometimes glitch and take you a long time to try different solutions. Enter your info to see your take home pay.

Ad Learn How To Make Payroll Checks With ADP Payroll. Starting as Low as 6Month. Pay employees by salary monthly weekly hourly rate commission tips and more.

LoginAsk is here to help you access Oregon Paycheck Calculator 2021 quickly and. How You Can Affect Your Texas Paycheck. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52.

Next divide this number from the. Ad Payroll So Easy You Can Set It Up Run It Yourself. Subtract any deductions and.

Indiana Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Oregon Paycheck Calculator Smartasset

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Maryland Paycheck Calculator Smartasset

Payroll Calculator With Pay Stubs For Excel

Payroll Tax Calculator For Employers Gusto

How To Calculate Payroll Taxes Methods Examples More

Oklahoma Paycheck Calculator Smartasset

Payroll Calculator With Pay Stubs For Excel

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Kentucky Paycheck Calculator Smartasset

Paycheck Manager Review Is It The Right Payroll Software For Your Business

Maine Paycheck Calculator Smartasset

How To Calculate Payroll Taxes Methods Examples More